Make Zest your employee benefits platform

Has your employee benefits platform and benefits offering kept up with how your people now work? A lot has changed in the last few years, and a clunky, one-size-fits-all benefits strategy no longer cuts it. Say hi to Zest and take your employee proposition to a new level with personalised benefits offerings aligned to your people’s needs, all through an intuitive platform and app.

Our customers

Brilliant brands giving their benefits some Zest…

Make the complex

simple

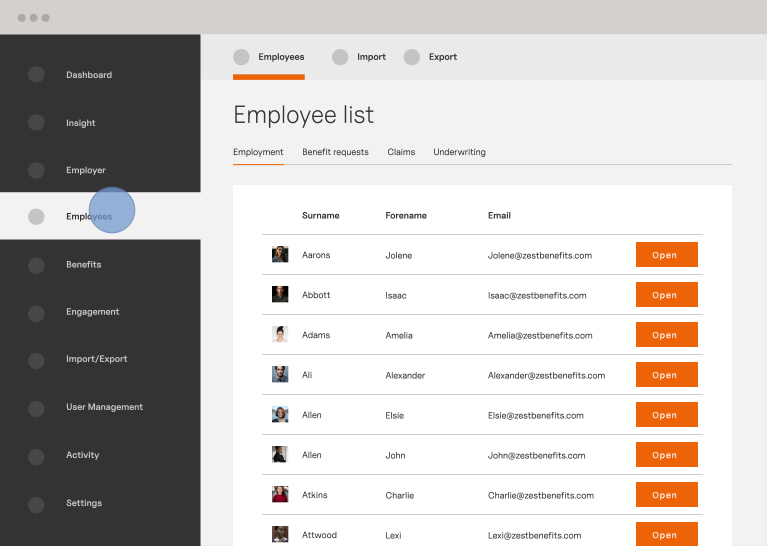

Zest makes managing your employee benefits schemes quick and easy, whether you’re a single business in the UK or a group of companies. And because our benefits system is updated in real- time, your benefits data is always accurate and up-to-date.

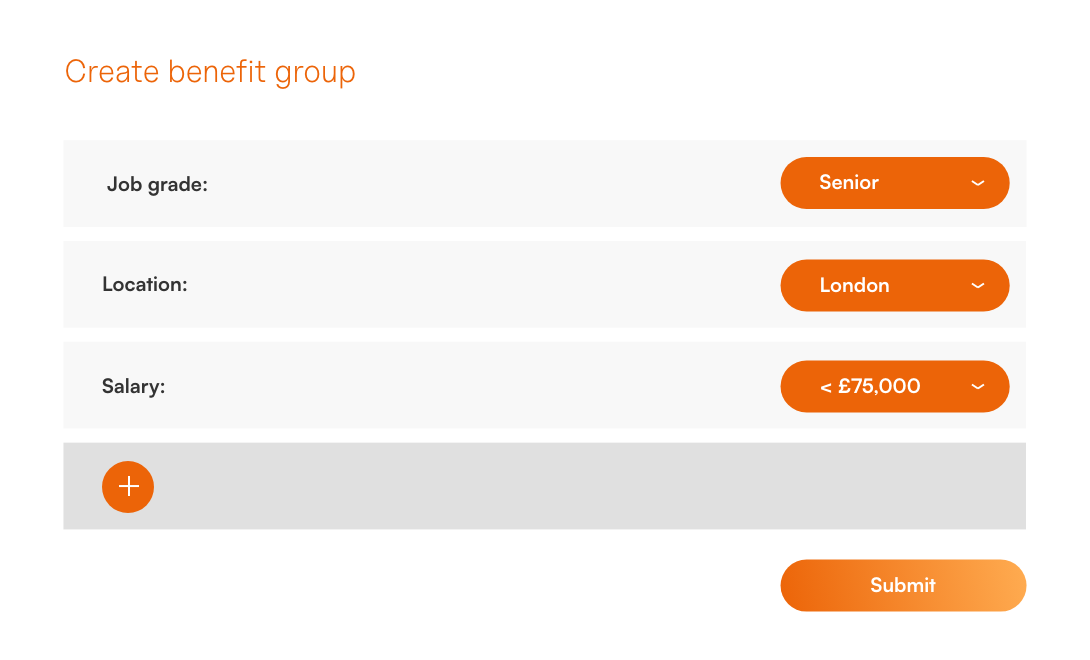

Say goodbye to manual processes, with Zest you can build your own rules to automate which benefits are available to each employee based on factors like job grade, location, salary or a change in the employee’s circumstances.

And because Zest has been designed to be flexible, we’ll get you up and running with your new benefits system in weeks rather than months or years.

Without data, it’s

just an opinion

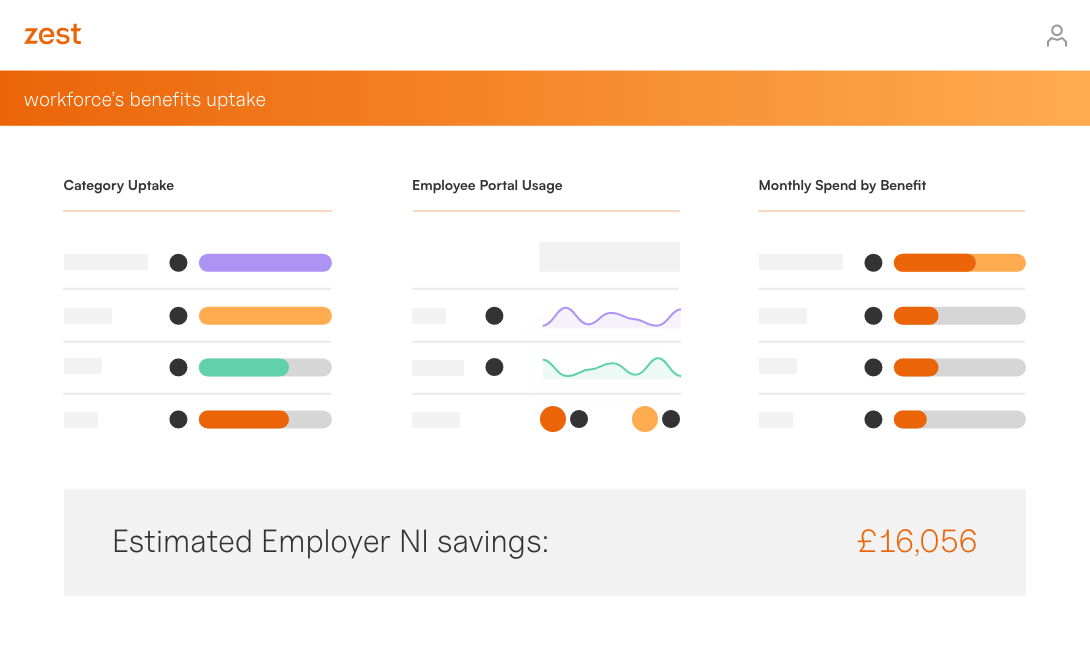

Get the insights you need to make smart decisions.

- Measure how employees use the platform, understand the benefits they’re choosing, identify which ones they’re not, and how this has changed over time.

- Explore the data, drilling down by employee characteristics like age, department gender and salary.

- View a dashboard of tasks for the HR or benefits team.

- Quickly identify employees who have, haven’t or are in the process of updating their benefits.

What they say

The Insight Centre enables us to delve

deeper and find out when, how and

why our employees are using the

platform, which is great

Ditch the one-size-

fits-all approach

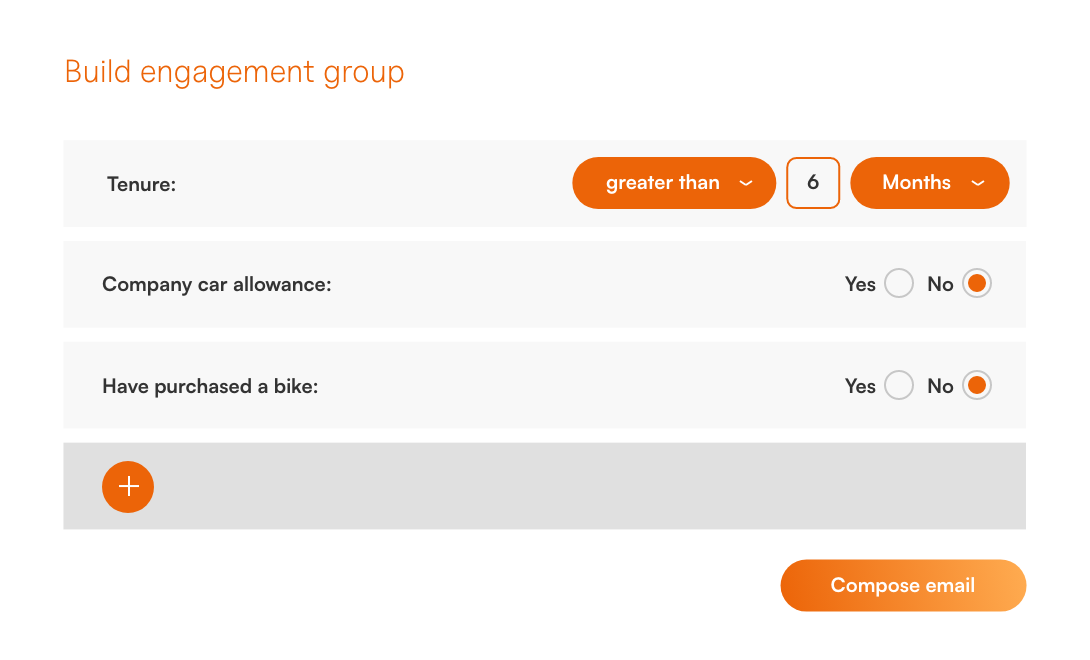

Every company and every employee is unique. That’s why Zest is personalised to every user, based on the benefits you offer, the benefits they have, and the messages you want them to see.

- Personalise your benefits portal for every employee.

- Drive benefits uptake with targeted communications.

- Send communications to individuals or groups of employees.

- Display banners to employees when they log in.

- Boost engagement with personalised, targeted content and communications.

- Schedule messages or send them immediately.

- Provide seamless access to people policies, resources and community activity, all within a single platform.

What they say

The platform has been pivotal in our communications with colleagues

Always accurate, easy

Zest keeps your data accurate and up to date with self-service tools and smart integrations that sync with HR, payroll, and benefits providers automatically. Customise and automate your data flow to eliminate manual reporting and administration.

Built for your people, not just your processes

Zest is designed with employees in mind – simple to use, easy to love, and personalised from the moment they log in. Whether they’re picking new benefits, or checking what they’ve already got, everything feels intuitive, relevant, and just… works.

With Zest you can

One platform,

loads of benefits

Manage all of your employee benefits with ease

What they say

It’s saved me time and a lot of manual work! This means I can focus on more critical things every month.