Important Changes to Childcare Voucher Schemes.

For many parents, or parents to be, something important is coming. On the 6th April 2018 Childcare Vouchers (CCVs) will change under government legislation and you will no longer be able to join your workplace Childcare Vouchers Scheme. Instead you will be able to join the government’s Tax-Free Childcare scheme which is not an employer supported form of childcare.

This is a big change for many parents, with considerable differences between each scheme. It is now the time for parents to choose. Whether they want to continue with their existing scheme, or switch to the new government scheme. You can switch over to the Tax-Free Childcare at any time, even after 6th April. But, consider that you may not be able to change back if it isn’t to your liking. So weigh up your options carefully.

Does your employer offer a Childcare Voucher scheme?

The existing CCV scheme allows parents to elect to take part of their salary as childcare vouchers through a scheme set up by their employer. This usually operates through salary sacrifice. With the amount you can elect to take in vouchers free from tax and NI contributions, saving you money.

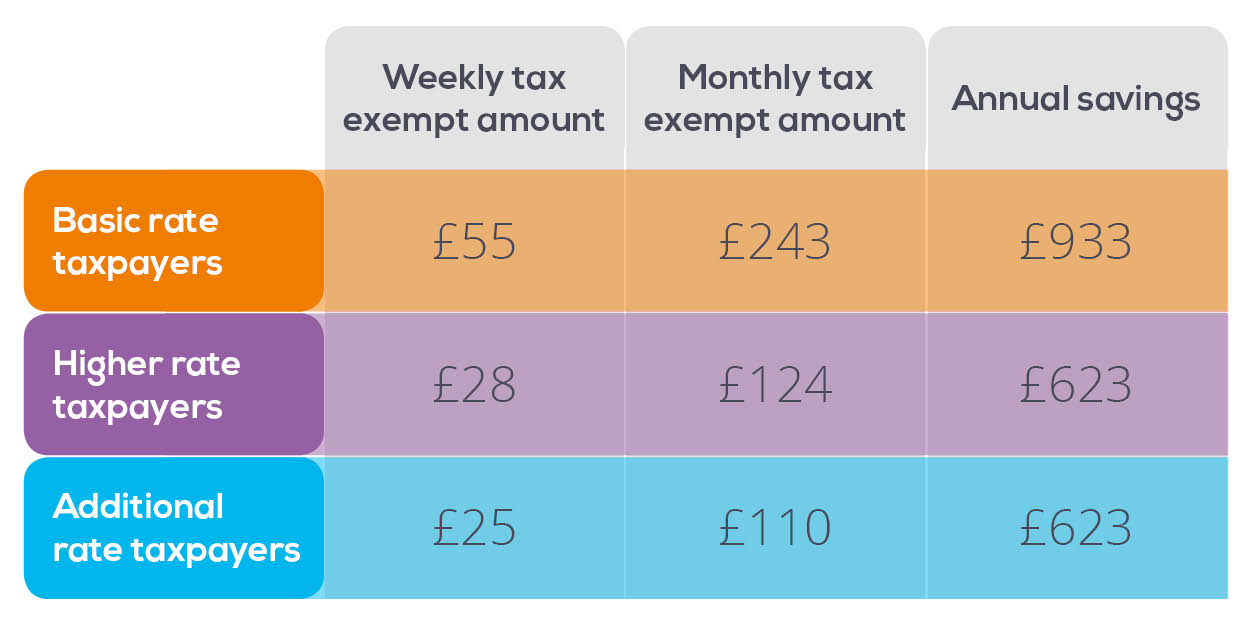

The amount of vouchers you can elect to receive and the savings you make depend on your tax band:

CCV can then be used to cover the cost of registered and approved childcare services.

If your employer offers this benefit, then many parents may currently be in the CCV scheme or considering joining. If you are unsure whether your employer currently offers this scheme, check with your HR department to see if it is available to you.

Check out the Differences

There are some key differences between CCV and the new Tax-Free Childcare scheme. These are worth considering when deciding which scheme is best suited to you:

Unfortunately, you cannot be in both schemes at the same time.

*Until 1st September after the child’s 15th birthday, or 1st September after their 16th birthday if they are disabled

** Different rules apply for those aged between 16 and 21

So what does this mean to you?

In short, if the current CCV scheme is more suitable for you, make sure you make the most of it by ensuring you join the scheme before the deadline. If you join the CCV scheme before the deadline, you can continue to benefit from the scheme for as long as you qualify***. Remember: if you change your employer after the April deadline, you will no longer be able to participate in an employer scheme. You will have to transfer over to the new Tax-Free Childcare scheme.

CCVs are typically an anytime benefit, but check availability with your employer. In April, if the government scheme looks more suited to you, you can simply inform your employer that you wish to opt out of the CCV scheme. Then move over to the new government scheme.

Note:

Some savvy employees, that qualify for childcare vouchers but don’t want to take full advantage of the scheme until a later date, are choosing to take the minimum voucher amount now to ensure they don’t miss the deadline. CCVs typically have a long shelf life, so they can be used at a later date when you expect to incur higher childcare costs (e.g. summer holidays). So, even if you are not using them now, you can build up a pot to use when appropriate. However, you can only join the scheme once your child is born.

Let’s review your current situation.

If you still need further input on making your scheme choice, check out this ‘better off calculator’ from gov.uk.

Remember, while the deadline to join the CCV scheme is the 6th April, this is for a deduction to your salary. Therefore, for those of you on a monthly salary you will need to have had a deduction from your March pay, which in real-terms brings forward the actual deadline to a February selection. That’s just over a month for most of us.

*** Until your youngest child reaches 16/17 if they have a registered disability

Related articles

Ready to find out how we can Zestify your business?